In business, predictive models exploit patterns found in historical and transactional data to identify risks and opportunities. Models capture relationships among many factors to allow assessment of risk or potential associated with a particular set of conditions, guiding decision making for candidate transactions.

Predictive analytics is used in actuarial science, marketing, financial services,insurance, telecommunications,retail, travel,healthcare,pharmaceuticals and other fields.

One of the most well known applications is credit scoring,which is used throughout financial services. Scoring models process a customer's credit history, loan application, customer data, etc., in order to rank-order individuals by their likelihood of making future credit payments on time. A well-known example is the FICO score.

-----------

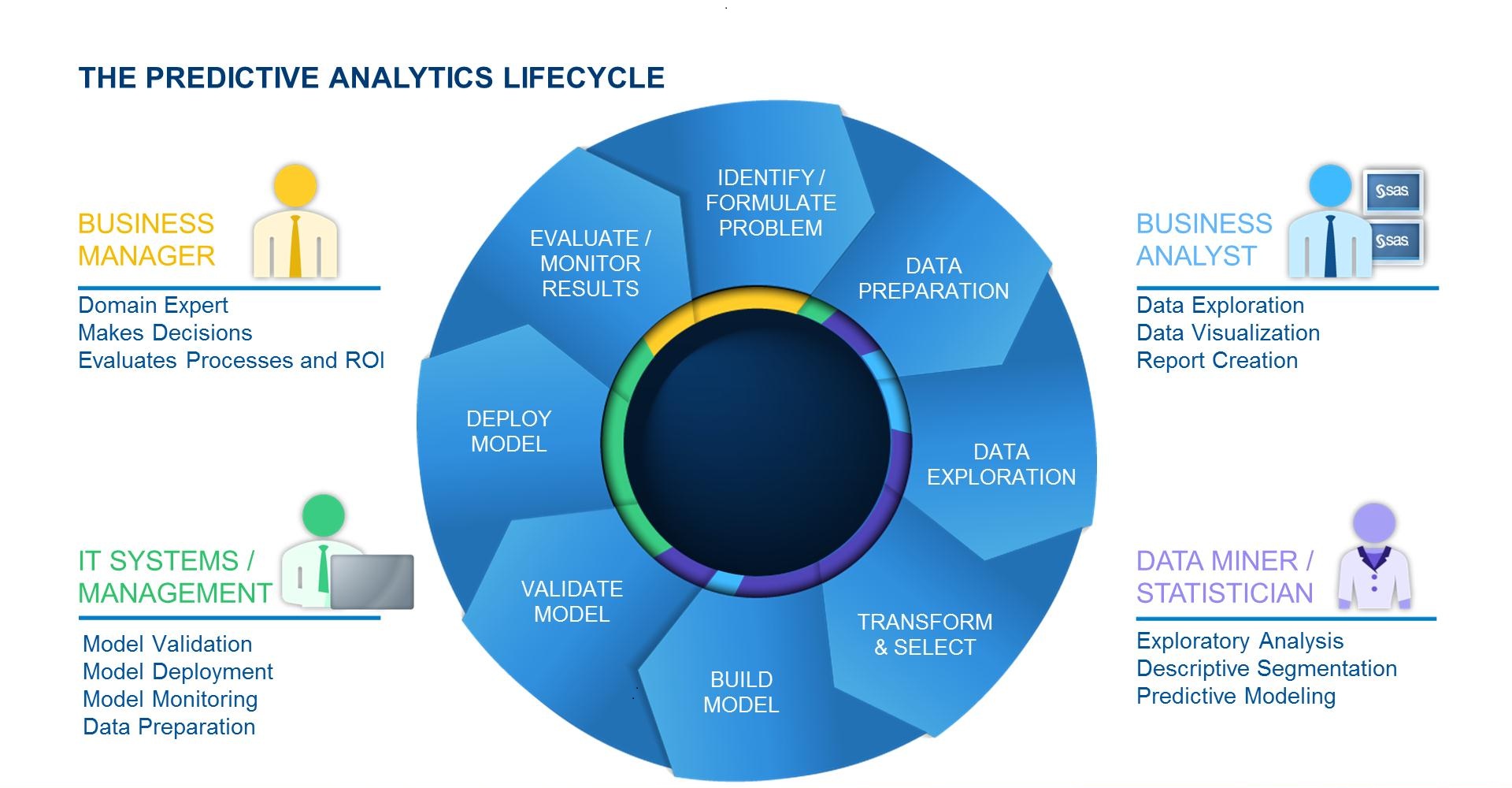

and here is the PA cycle

-----------

to make it simple see this video :

No comments:

Post a Comment